Tech Layoffs Are Signaling Something Much More Than a Downturn

- By Forrester analysts

- February 07, 2023

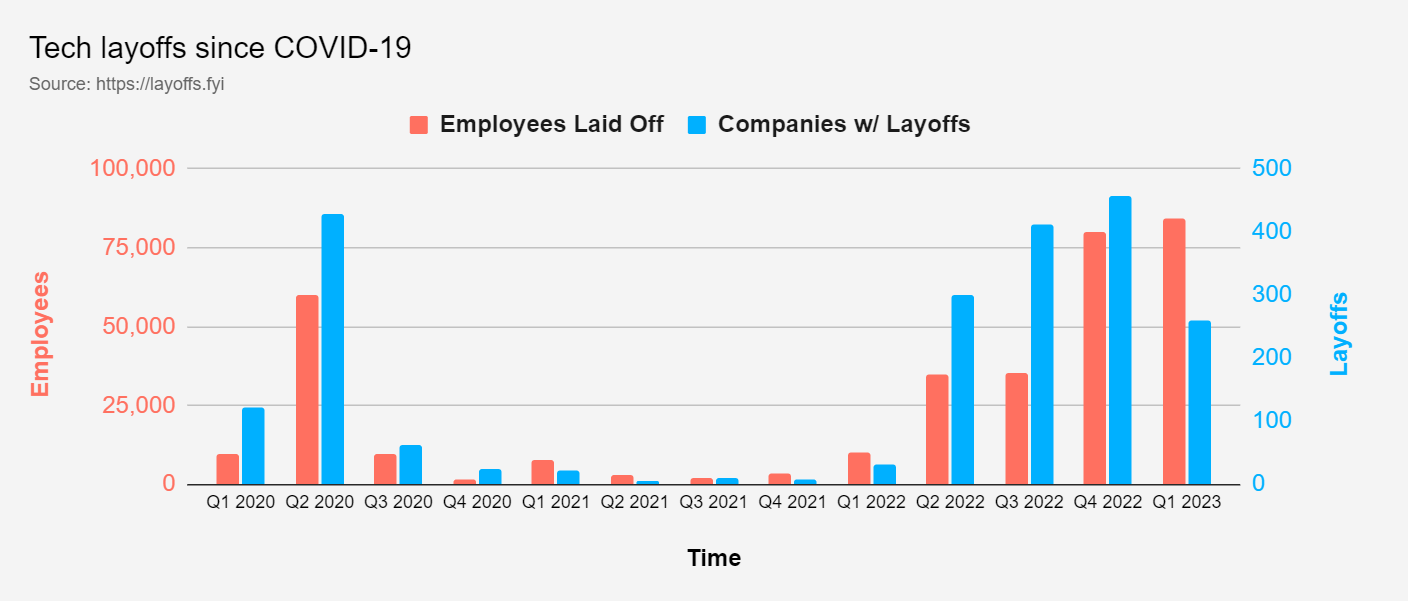

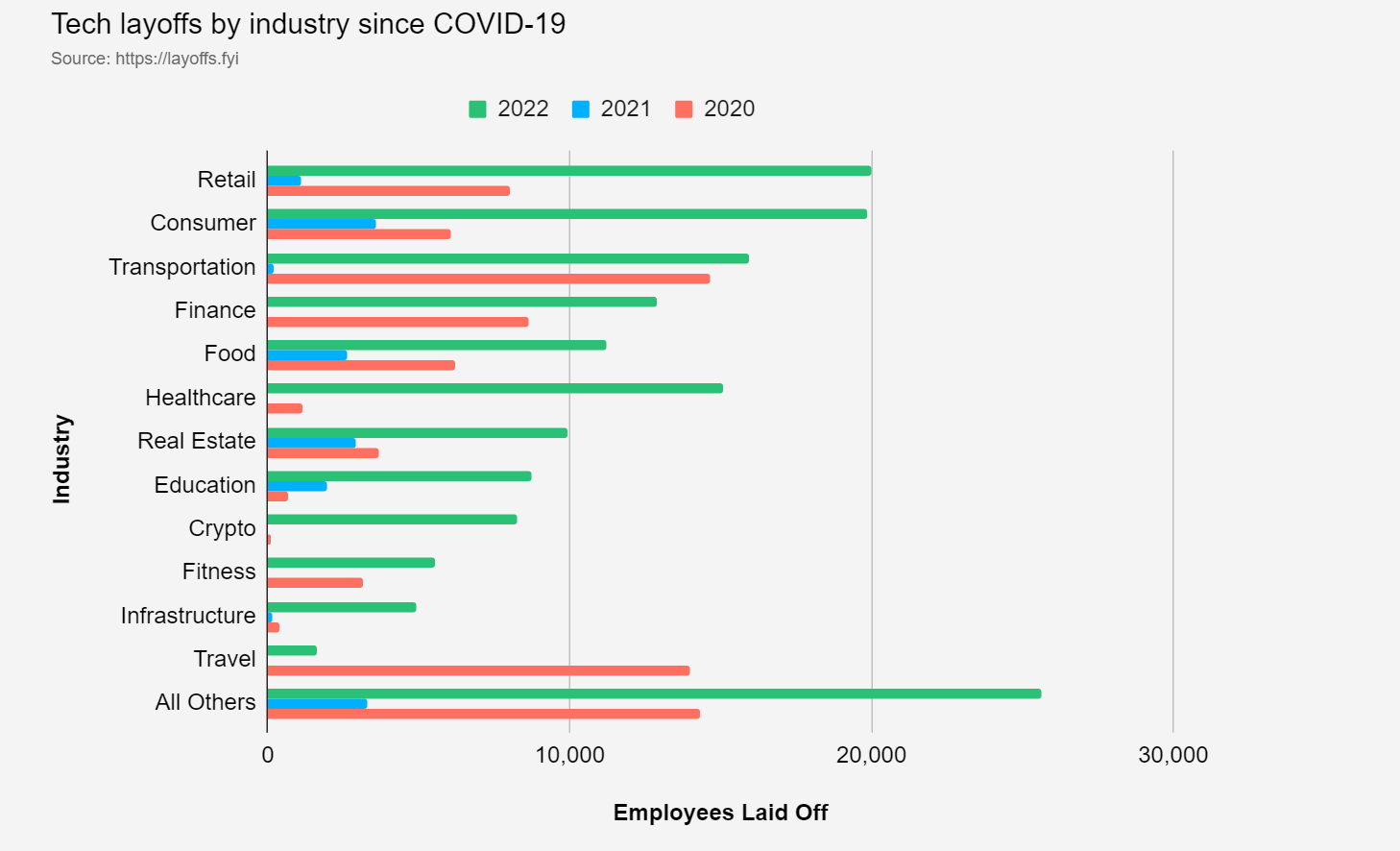

The pandemic revealed a very unique dynamic: Tech-centric companies captured significant gains in the market, while other types of companies had to react to the downside of drastic shifts in consumer behavior. Valuations within the tech industry ballooned through the pandemic as tech companies’ revenue strength outstripped the greater market. At one point, Amazon, Apple, Google, Meta, and Microsoft each topped 1 trillion dollars in market capitalization.

Oh, how the mighty have fallen. Today, these companies are 10%–50% below their peak valuations. These market corrections are leading to changes in employment. For instance, Microsoft is laying off 10,000 hires while Google is letting go of 12,000. Meanwhile, Amazon cutting spree will affect 18,000 job roles while Spotify and PayPal announced a 6% and 7% reduction in their workforces due to margin pressures, respectively. For big tech, the layoffs are a result of increased industry maturity: Companies that once focused single-mindedly on growth (even through the financial crisis) now must seek profitability for the first time due to shareholder pressures.

Margins are the leading indicator for big tech, not earnings, as evidenced by the higher-profile layoffs over the last 12 months. For big tech, the excess built through the pandemic was protected by high valuations. Now that the market is more accurately pricing risk amid the downturn and big tech is being priced like other industries, they must respond like their more traditional peers. For instance, Salesforce hit record earnings, but it announced layoffs as its stock price continued to fall.

More importantly, these layoffs appear to be a leading indicator for other industries. Quantitative tightening has begun to expose short-term margins in the financial sector. As a result, companies such as Capital One and Goldman Sachs have started making labor changes. As fed-driven demand destruction picks up pace, weaker earnings will begin to spill over into more sectors, precipitating more cutbacks. More layoffs are likely, but we should know by the summer if the market will have a soft landing.

Tech leaders: do not be too aggressive with short-term cuts that inevitably will force you to play catch-up in the long run. Instead, be aggressive with repositioning your workforce to expand core business growth and strengthen the durability of your advantage in the market.

This research falls under Forrester’s tech insights and econometric research (TIER). Some of the figures were updated by DWFTrends editors. The original article by Forrester's principal analyst Christopher Gilchrist, researcher Rachel Kwon, Michael Kearney and Anna Synakh is here.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of CDOTrends. Image credit: iStockphoto/AndreyPopov; Charts: Forrester